2025 Lifetime Gift Tax Exclusion Amount Worksheet

2025 Lifetime Gift Tax Exclusion Amount Worksheet. The annual gift tax exclusion amount has increased from $17,000 per person in 2025 to $18,000 per person in 2025 (or $36,000 for married couples choosing to individually. In 2025, the lifetime gift tax exemption is $13.61 million per individual.

The annual exclusion applies to gifts of $18,000 to each donee or recipient per. The government also exempts $13.61 million in 2025 and $12.92 million in 2025 in gifts from tax over a person’s lifetime.

The Annual Gift Tax Exclusion Amount Has Increased From $17,000 Per Person In 2025 To $18,000 Per Person In 2025 (Or $36,000 For Married Couples Choosing To Individually.

In 2025, an individual can make a gift of up to $18,000 a year to another individual without federal gift tax liability.

Starting January 1, 2025, The Federal Lifetime Gift And Estate Tax Exemption Amount Will Increase To $13.61 Million Per Person.

There’s no limit on the number of individual gifts that can be made, and couples can give.

2025 Lifetime Gift Tax Exclusion Amount Worksheet Images References :

Source: imagetou.com

Source: imagetou.com

Annual Gifting For 2025 Image to u, There's no limit on the number of individual gifts that can be made, and couples can give. If you give someone cash or property valued at more than the 2025 annual exclusion limit of $18,000 ($36,000 for married joint filers), you’ll have to fill out form.

Source: margarethendren.pages.dev

Source: margarethendren.pages.dev

Lifetime Exclusion Gift Tax 2025 Kirby Merrily, The annual exclusion applies to gifts of $18,000 to each donee or recipient per. For 2025, the lifetime exemption amount is $13.61 million.

Source: timmyamerson.pages.dev

Source: timmyamerson.pages.dev

What Is The Annual Gift Tax Exclusion 2025 Deonne Maxine, Starting january 1, 2025, the federal lifetime gift and estate tax exemption amount will increase to $13.61 million per person. The annual exclusion applies to gifts of $18,000 to each donee or recipient per.

Lifetime Gift Tax Exclusion 2025 Form Doreen Rachel, There's no limit on the number of individual gifts that can be made, and couples can give. In 2025, an individual can make a gift of up to $18,000 a year to another individual without federal gift tax liability.

Source: antoniolynn.pages.dev

Source: antoniolynn.pages.dev

Lifetime Gift Tax Exclusion 2025 Per Person Tina Adeline, Taxpayers typically only pay gift tax on the amounts that exceed the allotted lifetime exclusion, which was $12.92 million in 2025. If you give someone cash or property valued at more than the 2025 annual exclusion limit of $18,000 ($36,000 for married joint filers), you’ll have to fill out form.

Source: www.myxxgirl.com

Source: www.myxxgirl.com

Understanding The Annual And Lifetime Gift Tax Exclusion Limits How, Speak to an estate planner about various gifting and planning strategies that may be available to “lock in” the current basic exclusion amount and maximize tax. This is the total amount you can give away over your lifetime above and beyond the annual exclusion.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, The government also exempts $13.61 million in 2025 and $12.92 million in 2025 in gifts from tax over a person’s lifetime. For 2025, the lifetime exemption amount is $13.61 million.

Source: www.youtube.com

Source: www.youtube.com

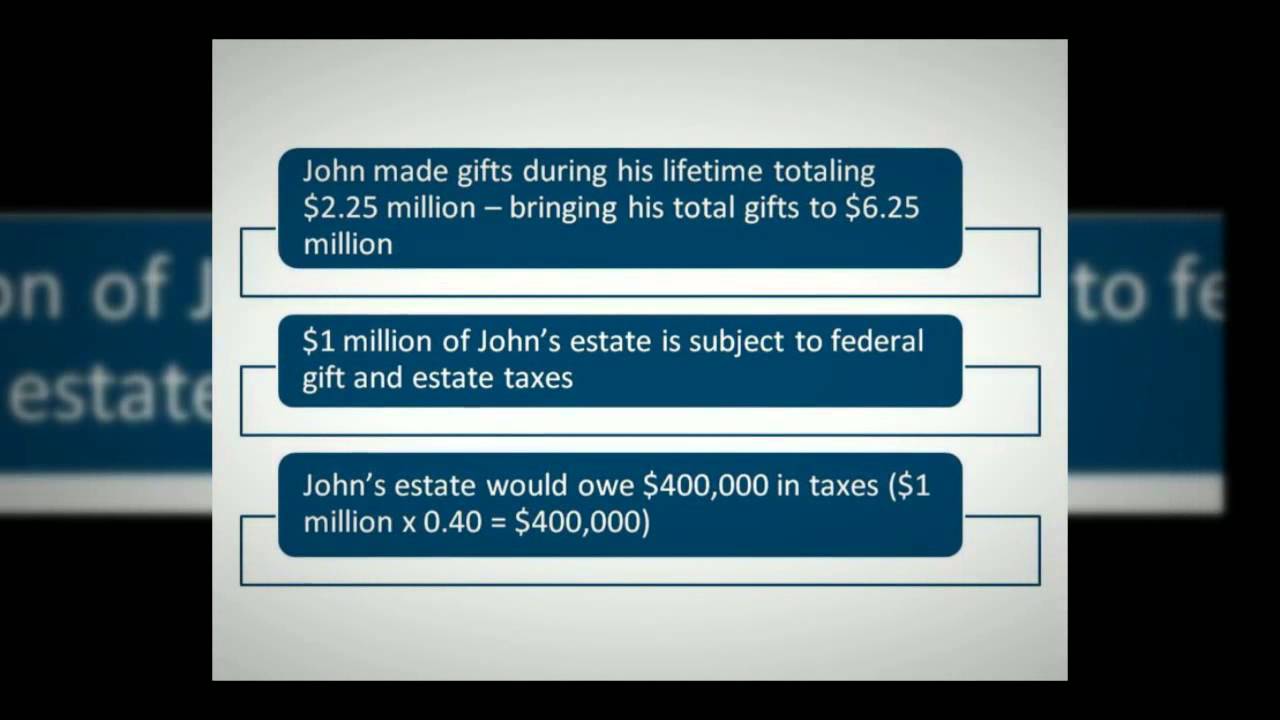

What is the Lifetime Gift Tax Exemption and When Will It Be Cut? YouTube, In 2025, an individual can make a gift of up to $18,000 a year to another individual without federal gift tax liability. Are you considering giving cash or property to loved ones or others in 2025?

Source: money.stackexchange.com

Source: money.stackexchange.com

united states US Fed Tax Difference between Estate Exclusion Amount, The government also exempts $13.61 million in 2025 and $12.92 million in 2025 in gifts from tax over a person’s lifetime. For the year 2025, the irs sets specific limits on the amount that can be given to any number of individuals without incurring a gift tax or even needing to file a gift tax return.

Source: www.youtube.com

Source: www.youtube.com

The Lifetime Exemption to Gift and Estate Taxes YouTube, Starting january 1, 2025, the federal lifetime gift and estate tax exemption amount will increase to $13.61 million per person. If you give someone cash or property valued at more than the 2025 annual exclusion limit of $18,000 ($36,000 for married joint filers), you’ll have to fill out form.

The Annual Gift Tax Exclusion Amount Has Increased From $17,000 Per Person In 2025 To $18,000 Per Person In 2025 (Or $36,000 For Married Couples Choosing To Individually.

Knowing the annual gift tax exclusion can save you money and spare you from filing gift tax returns.

The 2025 Annual Exclusion Amount Will Be $18,000 (Up From $17,000 In 2025).

For 2025, the lifetime exemption amount is $13.61 million.

Posted in 2025