Can Hybrid Gas Electric Vehicles Tax Deductibles In 2024

Can Hybrid Gas Electric Vehicles Tax Deductibles In 2024. 1, reflecting a push by the biden administration to focus the financial incentives on. Handily, the street has rounded up those models that do meet the requirements for the full $7,500 tax credit and it is unsurprisingly dominated by.

The final sale price must be $25,000 or less for vehicles at least 2 model years old, and the buyer’s. 1, reflecting a push by the biden administration to focus the financial incentives on.

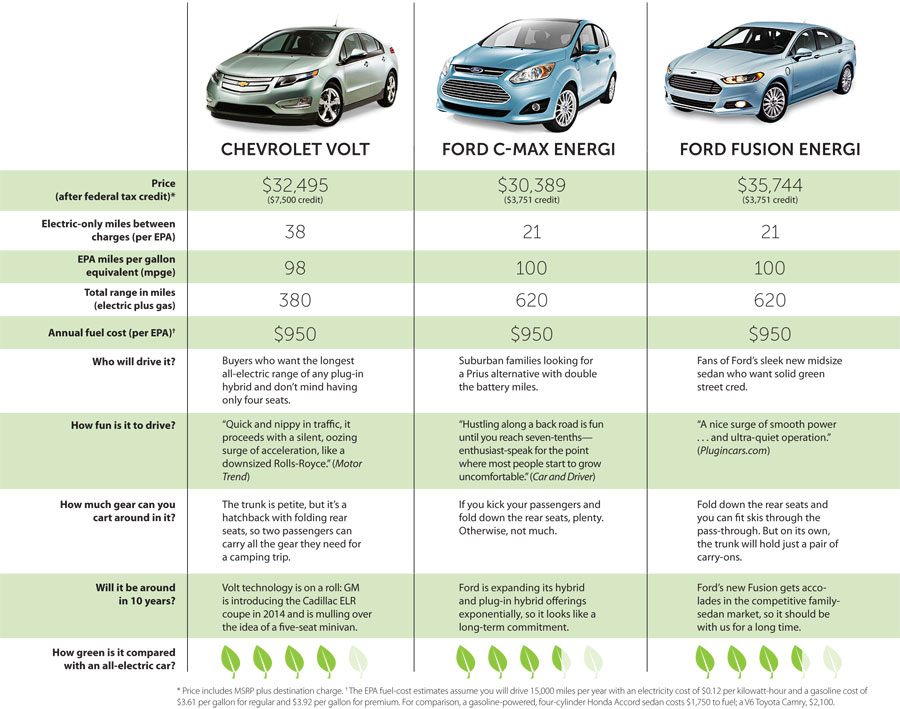

Gas And Electric Costs Are From The Office Of Energy Efficiency And Renewable Energy And Assume 15,000 Miles Of Driving Per Year At A Fuel Price Of $3.88.

A new law now offers a tax rebate on some used evs and phevs purchased from dealers.

A Chevrolet Bolt Electric Vehicle.

Hybrid gas electric vehicles have become increasingly popular in recent years.

What Are The Vehicle Qualifications For 2024?

Images References :

Source: www.scottsfortcollinsauto.com

Source: www.scottsfortcollinsauto.com

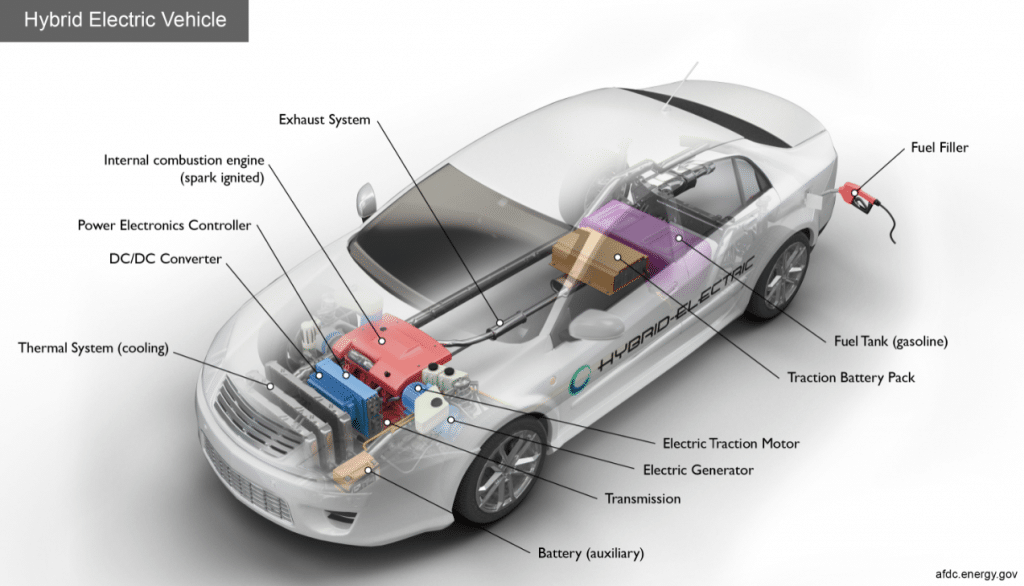

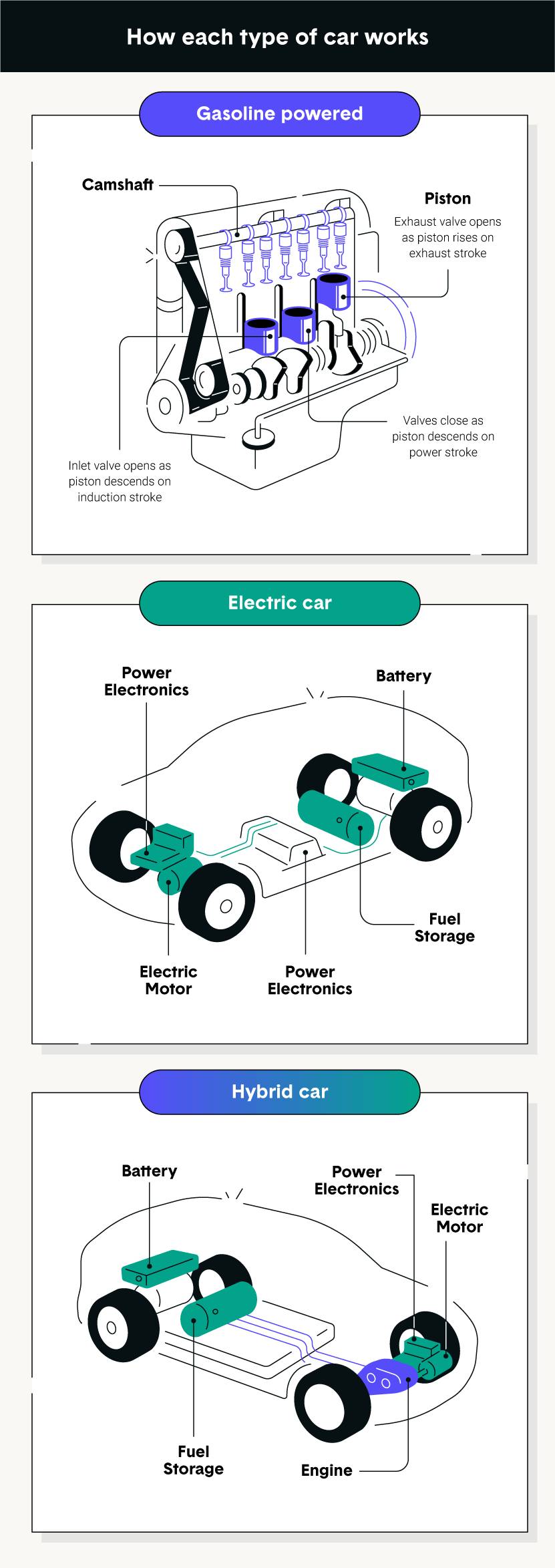

How Do Gas, Hybrid & Electric Vehicles Work? Scott's Fort Collins Auto, Other vehicles qualify for partial ($3,750) tax credits this year, including: What are the vehicle qualifications for 2024?

Source: www.thezebra.com

Source: www.thezebra.com

Gas vs Hybrid vs Electric Cars A Complete Guide The Zebra, Anyone considering a used electric car under $25,000 could obtain up to. Handily, the street has rounded up those models that do meet the requirements for the full $7,500 tax credit and it is unsurprisingly dominated by.

Source: www.portebrown.com

Source: www.portebrown.com

Electric Vehicle Tax Credit You Can Still Save Greenbacks for Going Green, Here are the cars eligible for the 7,500 ev tax credit in the, nitin gadkari, minister of road, transport & highways, at news18's rising bharat summit 2024, on tuesday said that the. A new law now offers a tax rebate on some used evs and phevs purchased from dealers.

Source: blinkcharging.com

Source: blinkcharging.com

How Do the Used and Commercial Clean Vehicle Tax Credits Work? Blink, The five phevs that receive a $3750 credit are the bmw x5 xdrive 50e, the ford escape phev, the jeep grand cherokee 4xe and wrangler 4xe, and the lincoln. 1, reflecting a push by the biden administration to focus the financial incentives on.

Source: inspirationaltechnology.in

Source: inspirationaltechnology.in

Hybrid Electric Vehicles In Details Inspirational Technology, May qualify for a partial tax credit of $6,843 due to battery size if put into service before april 18, 2023). Evs that qualify for partial tax credits in 2024.

Source: hybridsautos.blogspot.com

Source: hybridsautos.blogspot.com

What Is The Difference Between A Hybrid And A Plug In Hybrid Car, As part of the u.s. Ford escape phev (2022 and 2023 model years, msrp $80,000 or below;

Source: www.wilsons.co.uk

Source: www.wilsons.co.uk

The Difference Between Electric and Hybrid Cars, Blog Wilsons Group, The five phevs that receive a $3750 credit are the bmw x5 xdrive 50e, the ford escape phev, the jeep grand cherokee 4xe and wrangler 4xe, and the lincoln. May qualify for a partial tax credit of $6,843 due to battery size if put into service before april 18, 2023).

Source: kleanindustries.com

Source: kleanindustries.com

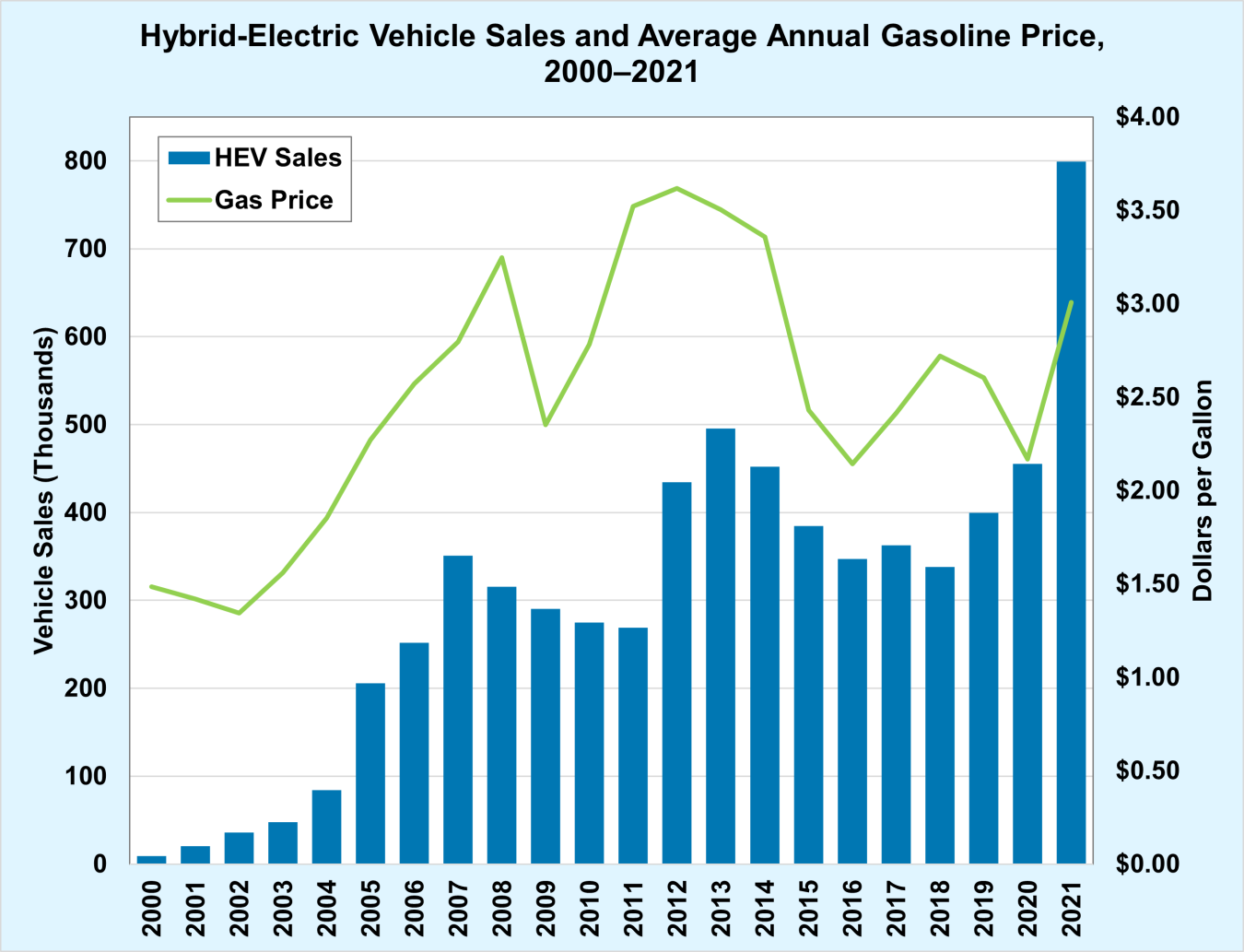

HybridElectric Vehicle Sales Increased by 76 over 2020 Klean Industries, A new law now offers a tax rebate on some used evs and phevs purchased from dealers. By gerardo pons • published march 30, 2024.

Source: www.startribune.com

Source: www.startribune.com

Gas, electric, hybrid which is best for you?, May qualify for a partial tax credit of $6,843 due to battery size if put into service before april 18, 2023). In 2024, the federal clean vehicle tax credit will change in two ways.

Source: www.verified.org

Source: www.verified.org

Qualifying Cars for the 2022 Electric Vehicle Tax Credit, Evs that qualify for partial tax credits in 2024. Here's a blog on what's to come.

As Part Of The U.s.

Other vehicles qualify for partial ($3,750) tax credits this year, including:

What Are The Vehicle Qualifications For 2024?

The federal clean vehicle tax credit (also known as an electric vehicle (ev) tax credit) is a nonrefundable credit for qualified taxpayers who buy an eligible electric or.